By: Fredwill Hernandez

“Good morning everyone, welcome back to Marina Del Rey for another Digital Entertainment World [DEW], this is our “seventh year.” Let’s have a hand for Tinzar my wife, for making all this happen, there she is in the back. Actually Tinzar, Ginny and the whole entire team at Digital Media Wire who are doing an extraordinary job. It’s a pleasure to be here again,” eloquently expressed Ned Sherman, CEO / Founder of Digital Media Wire during his opening remarks. “Streaming Wars, Media consolidation, [The] Gaming Eco-System [eSports], The Future of Advertising, and Podcasting are “five trends” [topics] I’ll be going over and quickly touching on.”

Sherman who is also Counsel / Director of Manatt Digital [a fully integrated professional services division within Manatt, Phelps & Phillips, LLP], “who also founded” the DEW Expo described how he sees [The] Streaming Wars as, “With all the new services that are competing today with traditional studios and broadcasters there couldn’t be a more exciting time to be in the content industry. The budgets for content are unprecedented and we expect over the next five years — there are going to be a steady flow of productions, licensing, and deals in the content space. I think that when we look at and what we are seeing — is there is a real emphasis on premium content, content that is produced by A-list directors, top show runners, top talent, IP that is recognized in some cases– unless its original IP, this is going to be the differentiator – this is where the money is really flowing. People with access are in a real good position to capitalize. One of the things we are seeing is a renew interest by investors and I think for many years Hollywood’s been relying on money from overseas in particular China, over the last five to seven years – but the Chinese’s money is dried up with the current [USA] administration and the trade wars we have and it makes it — a very interesting time. We are seeing interest from Sovereign Wealth Funds [SWF], family offices, strategic partners – there’s are a lot of people coming out the wood works that would probably not be looking into investing in content as an opportunity, so there’s a lot of activity in creating slate funds in all kinds of content –again to the one’s that have access to top talent, top IP — I think will be very well positioned. This is something we are seeing and I think [predict] it will continue for the next five years.”

As to Media Consolidation — Sherman explained, “Obviously we’ve seen some of the biggest deals of out lifetime in the last few years with at & t [Time Warner], Disney [Fox], CBS [Viacom] – there are still some others and rumors about and I think we will continue to hear there maybe some other big deals to come — MGM, Lionsgate, Roku, Sony Pictures and others that are constantly talked about in the media. One of the things we are seeing [another development] anytime there’s M&A [Mergers & Acquisitions] there are also people [exec’s] leaving companies, and some real top people are leaving studios and they have relationships, they have [the] knowledge and they know how to work within the studios system and they are starting their own operations – and I think that is a very exciting space. One thing to keep in mind [though] its very different than when a start-up launches, where they get funded and get it running – it’s a different business [totally] than running a division at a studio [per se]. There’s some challenges, but also huge opportunities, were seeing money [investors] looking for those opportunities and a lot of deal flow that’s going to be directed towards these new [type of] studio start-ups.”

On eSports, Sherman, added, “Everyone is trying to figure out eSports –there’s a lot of attention [here]. There’s a growing business and there is a lot of revenue being generated in this space. I think some of the early investments in the space were looking to franchise [their teams], but It didn’t pan out as [some] expected, I however think there is a big opportunity around tools, technology, and services around media in eSports and we are seeing a lot of activity in that space. We do a lot of representation with streaming deals in this space – particularly with Twitch and Facebook, we’ve done some of the biggest deals in this space over the last two years and we see that area just continuing. Everyone is looking for the streaming side to lock up the talent and content providers that are fueling this demo, so that’s very exciting.”

Sherman also began to explain his take on [The] Future of Advertising by asking, “How many people watched the Super Bowl [?] It’s pretty clear that the future of advertising is content and that the advertisers [the brand] is now looking at themselves as a media companies. There were some winners and there were some losers like every year but the degree of productions was interesting to watch, how much money is spent — how much talent involvement is in advertising today. We’re doing a lot of content marketing deals, digital is the platform now, that’s pretty clear and influencers are a huge part of it, so influencers deals are going to continue as well.”

The fifth a “last thing” Sherman touched on was on the interest and growth in [The] Podcasting space, “I’m going to wrap with an area that is kind of new in terms of being a new shinning object that media is looking at — is Podcasting. I think this is interesting because for many people were just trying to figure out what is Podcasting, why are people doing this [?] Well we are now seeing real revenue coming out from [The] Podcasting Industry. For some companies it’s a new revenue channel, it’s answer interactive but for some of our clients – it’s where new ideas are being developed, new franchises and a foundation of ideas that can be developed into revenues across other platforms. There’s a huge power grab going on in this space, so look out for deals that involve significant advances for key talent and there’s going to be a lot of consolidation [we think in this space] particularly with Spotify, and Amazon and some of the other big media companies that are placing a bet in this space.”

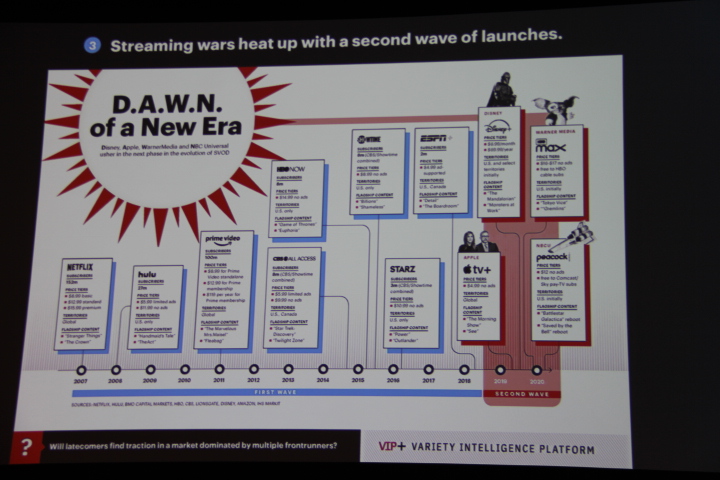

Some of the [current] trends and predictions Sherman shared were quickly confirmed by Andrew Wallestein, co-Editor-in-Chief, Variety — during his [brief] presentation The View From Hollywood: State of The Media Business 2020, “Let’s set the stage where business is right now. When you think about traditionally media companies they are clearly outsized, outmatched by these gigantic tech companies that are basically eating the lunch of these traditional companies, taking over and absorbing the advertising revenues, the subscription revenue but this is not new. What is new, what is new [I think] is how the media companies are fighting back. Number one – as we clearly saw in 2019, M&A [Mergers & Acquisitions] grew in high gear. We saw some pretty high combinations of companies. I think it will slow down in 2020, I don’t necessarily know we will see the same amount of deals as we saw in 2019, but you can see at the bottom of the chart – there’s plenty of what John Malone [The Billionaire media mogul] calls ‘free radicals’ that can be absorbed, look at MGM — that’s the company everyone is looking at.”

Wallenstein described Streaming as the story [still to come] of the next few years, “The market was pretty much set in place by Netflix and Amazon [Prime], we are now seeing a second wave that you may have heard of – some runs into Disney + of course, [had a] hugely successful launch, very impressive. Apple’s come in, but I think we are going to have to play wait and see on that one. They’ve made some progress but they’re not the success that Disney + is. I think what’s interesting, in 2020 were going to see more out from at&t, HBO Max, Peacock, NBC Universal, but I think the game’s changing a bit where is not just about subscription dollars, it’s also about advertising dollars – this is going to be the year where we’ll get a sense were advertising and subscription revenue play out.”

Every year one or two exciting things “stand out” at DEW and this year was no different. One very interesting thing which stood out was Stemit’s AI [Artificial Intelligence] music stemming algorithms technology created by Audionamix, where Stemit can [now] extract from a [two track] music audio [WAV file] to separate the file into “separate stems” [tracks].

“The product was completed in Jan 2019. Because it is “licensed exclusively” by Stemit, from Audionamix, it does not have a commercial name. However, under our license agreement with Audionamix, the name we use is BigEx. The time it takes to extract the stems is close to real time. Thus, for a 2-stem extraction it takes 1/3 the length of the song. Thus, a 4 min. song will take 1 min 30 seconds. A 4-stem extraction takes 1 and 1/3 the length of a song. Thus, 5 minutes 30 seconds for a 4 stem song,” eloquently explained Joshua Kaplan, CEO – Stemit. “In terms of time to stem, we can currently extract up to 4 stems: vocals, percussion, bass and backing instruments. As the AI learns more, it can extract more. We plan to next focus on extracting keyboards and guitars. Certain labels are providing us training data to allow for this to take place. We are currently focusing on several use cases, such as education and karaoke. There is strong interest in using stems for those applications. Stemit charges the rights owner $100 for a 2-stem extraction and $200 for a 4-stem extraction. The Company participates in downstream revenues which allows us to keep stemming costs very affordable.”

Another cool [and very interesting] company who is bridging the gap between “art and streaming” through a visual streaming platform — is Loupe.

“All forms of media and intellectual property have been transformed, monetized, and disrupted by streaming with one exception: the art world is still operating on a model of the past. Loupe [art] is working to bring this 65 billion a year industry into the modern era with visual streaming platform that can bring culture into our homes and lives. Three connects of converge between the opportunity. Today we have these beautiful 4k — 65 inch TV’s in our home, beautiful screen and video walls in hotels, offices, airports – and too often they are blank empty screens or under utilized with low engagement advertising, repetitive news, or filler screen stickers. Mean while streaming has taken over our lives, hundreds of millions of subscribers on ad supported platforms, and what are we accustomed to [?], immediate assess to high quality personalized unlimited content. Then we have the art world — the fastest growing sector is online, but its definitely 90s – people buying prints from click and scroll websites and it’s not taking full advantage of the streaming economy, it’s not taking advantage of the streaming revolution – so its not realizing its [full] potential for discovery. Yet it’s the fastest growing sector of the art market. No one has [up to now] successfully reinvented how art comes into our lives. So we launched loupe [originally] exclusively on Apple TV, where we are the number one lifestyle app in 50 countries around the world, we have on average a two-hour user session[s],” eloquently explained Dot Bustelo, CEO & Founder, Loupe — the destination where users [through streaming] can now view art from around the world, and “if they like it” – purchase it.